In today’s world, there has been an increase in fraud and scam cases in the digital banking platform. For instance, like, last week there was an audio being circulated in WhatsApp where a person’s money had been laundered from his own bank account by scammers who had asked him certain questions pretending to be an official from bank, and the audio shows him wailing over his loss as he was a daily laborer as well.

Another family friend of mine had got trapped in the same scoundrel when he entered his bank details into a website that probably was a fraud. This was not the first time I’ve heard about banking fraud and I can guarantee this isn’t going to be the last. It terrified me of thinking how I would feel, if I just opened my bank account one day to see unknown transactions made from my account and my money looted. It kept me thinking on how many people have fallen under this fraud scams and how if it is possible for AI methods could help us detect banking fraud. This lead me to the topic on how Machine Learning methods can be used for solely this purpose. In this blog, I’ll break down mainly on how Machine Learning helps detect banking frauds and what all these actually means to you. Let’s start with explaining what exactly is Machine Learning!

What is Machine Learning?

When you are surfing through YouTube videos, if you think about how YouTube knows what to recommend as the next video or how when you type something in YouTube or Google or any other text bar on the internet, it already finishes the sentence for you, then you’re somewhere near to understanding what Machine Learning is. Machine learning is a type of Artificial Intelligence (AI) that allows computers to analyze and study data and also decide on what the next step is to be without being programmed for each and every step.

In the case of detecting fraud, machine learning models study huge amount of transaction data so that they can identify behaviors or patterns that are quite not normal or unusual. The plus point in this is that, in addition to depending on pre-set rules and regulations, they can also evolve to new types of frauds that occur, which makes ML effective in finding out the anomalies and stopping the possible threats before they arise. Now, let’s see how it detects fraud in banking.

How does Machine Learning Detect Bank Frauds

Talking about how it detects banking frauds, in simple, it’s like this- it depends completely on data. As we know, banks produce and have a large circulation of data, maybe about millions or billions of data, about transaction each day. Each of these data consists information like where it was made, how much money was spent in it, at what time the transaction took place, and so on. By taking all of these into account, ML checks for abnormal behaviors. Let me put the steps into step-wise points:

1. Collection of Data

Machine Learning systems begin by getting a collection of large historical data. In the case of banking, data collection means data of legitimate transactions, in addition they also take cases of scams, so that can identify the patterns. These data plays a role of a baseline that shows models what are the normal patterns and what are abnormal patterns or considered suspicious.

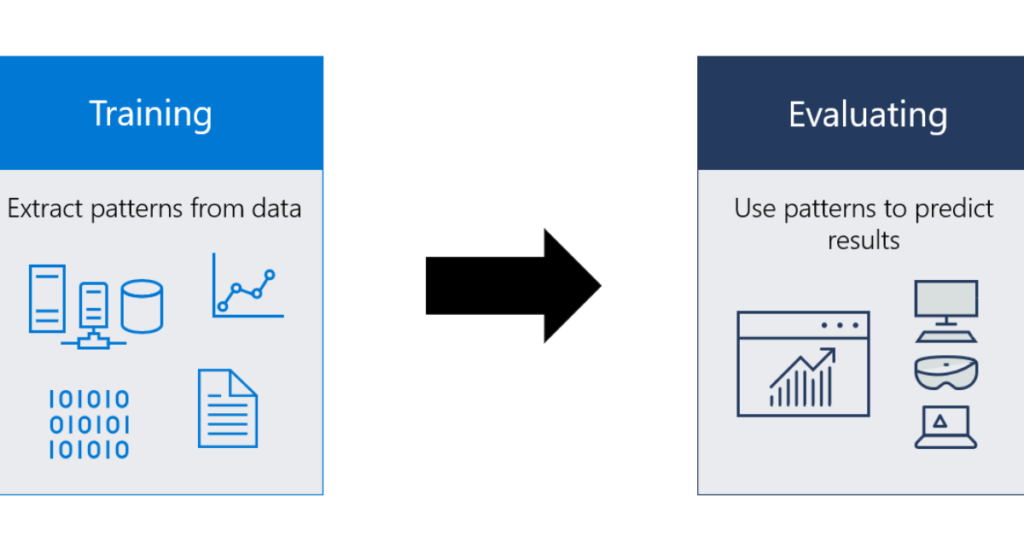

2. Training of the Models

This step includes training of these machine models. Data scientists use the data which was collected so that the models can be taught to differentiate between fraud and a normal behavior. These models then learn by comparing legit transactions to the fraud cases of transaction and then observing their patterns.

3. Detecting & Alerting

After the stages of training are completed, the model will be able to process real-time live transactions. It keeps analyzing for abnormal behaviors, i.e. basically patterns that don’t seem normal. Let’s take an example, if you usually do shopping in one specific location and all of a sudden, you make a huge transaction in some completely different location around the world, then this model would consider suspicious and keep it in radar. It then would alert the banks, which can either give an alert to the customer or cancel the transaction.

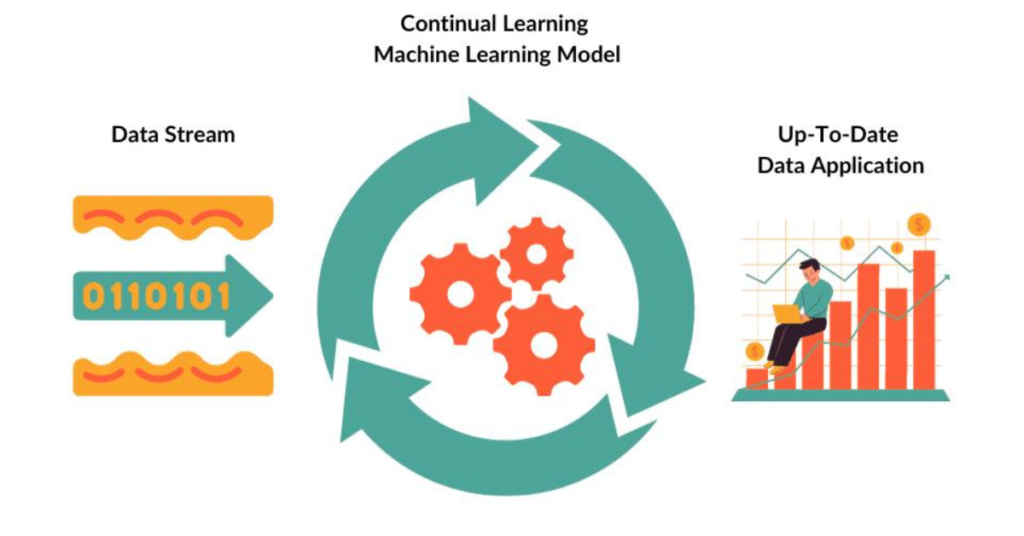

4. Continuous Learning

Along with all these steps, there is a continuous process of learning going on. It keeps developing and improving as it gets into more circulation of data. As day by day, the scammers get new unique ways to fraud, the model starts adapting and learns to identify those tricks as well. This allows the models to remain effective even when the patterns of fraud keeps transitioning.

Types of Fraud Machine Learning Can Detect

You’ve to know that not all fraud cases look the same, they come in different forms and machine learning is usually versatile enough to identify a range of these fraud cases. As per today, the most common ones are :

- Credit Card Fraud Cases: The models identify suspicious patterns on how money is being spend or suspicious locations which are unauthorized.

- Taking Over of Account: This can be in the case of a hacker, in this case the machine learning models will be able to identify them by unusual login behaviors, like a different or a new device being used or different time zone.

- Money Laundering: By going through data of various transactions, Machine learning can identify the complex patterns money launderers use, which most commonly involves transferring money through so many accounts so that the origin will remain hidden.

Machine Learning Vs. Traditional Methods

Before the introduction and spreading of AI, banks strictly abided by rule-based systems. Depending a specific set of predefined rules, these systems used to block transactions, for example a rule that still does exist in certain countries i.e. blocking international transactions above a specific amount or a certain currency. I can say, these rules did work but not for long as these rules were stable and did not adapt or evolve. These rules were also known by fraudsters and it was easily identified by them and they could bypass them easily.

In comparison, Machine Learning doesn’t have this problem as it has more flexibility and is also more dynamic. It keeps learning from the new data that keeps getting added and can identify unique patterns that a model using rule-based system would miss out. For instance, even though a fraudster can keep having transactions within the rule-based limit, they still have so many other ways to scam people. Machine Learning can identify those strange patterns before the scammers can cause a serious impact.

Challenges of Using Machine Learning

Everything has a good side and a bad side, so does Machine Learning. It does have advantages but it also has drawbacks for fraud detection. Firstly, it’s about the privacy concerns which is a major issue in the banking field. Banks are obliged to make sure that they use the personal data with at most care and follow regulations like the GDPR.

Secondly, it is the false positives. In certain cases, a machine learning model may tag a normal transaction as fraud and give an irrelevant block or alert. So it is important that banks know to balance between the convenience of customers and security.

Future ahead of Fraud Detection

Since we know, AI and all these Machine Learning models have just emerged and are still developing, it does take time but the future of fraud detection looks like it’s going to be bright. With further improvements in deep learning and natural language processing (NLP), fraud detecting models in the future would be even more accurate. There are chances that these upcoming models will not just analyze data but could also integrate text data from phone calls or even emails, making further improving the capabilities of fraud detection.

To finalize, especially in the contemporary world, which is fast-paced, it is quite difficult for the traditional fraud detection methods to keep up. With AI spreading globally, Machine Learning provides banks a much faster, smarter and a more adapting method to fight fraud. By going through large bundles of data and learning continuously, machine learning models play a big role in assisting banks to stay one step further than the scammers. If you are in banking, or if you know someone in banking, maybe it’s time to think about this method, since banking frauds are an important scenario in today’s world.

If you want to have a more visual information and tutorials on how Machine Learning is used for fraud detection you can check out the video below:

Frequently Asked Questions (FAQs)

1. Is Machine Learning quick in detecting fraud?

Yes, it usually identifies fraud in real-time, maybe even within milliseconds of a transaction occurring.

2. Is there complete elimination of fraud by Machine Learning?

There is no system that completely eliminates as they aren’t 100% foolproof, but the plus point of machine learning is that it does reduce the chances of frauds by identifying the abnormal patterns which other systems may miss.

3. Which type of data is used by Machine Learning in the banking field?

They usually use transactional data, such as transaction amounts, their locations, their time zones, the specific spending patterns of customers and also previous fraud cases which are used for training purposes of these models.